Introduction

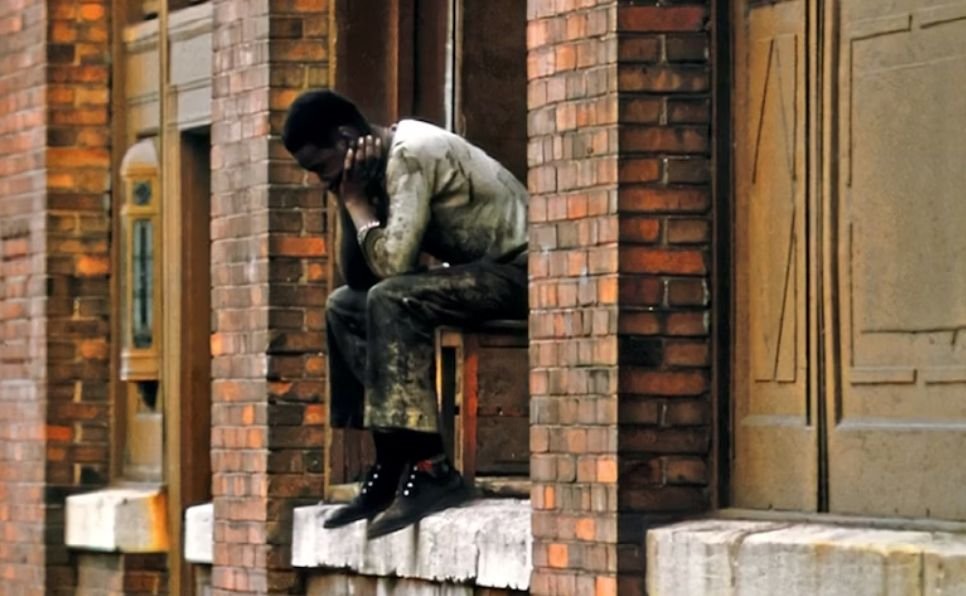

Being unemployed and in need of financial help is stressful. You might wonder: can you get a personal loan without a job? The short answer is yes, but it’s not easy. Many lenders require proof of income before approving a loan, but there are still ways to access funds when you’re between jobs. Whether you’re saying, “I need money desperately no job,” or trying to figure out how to get approved for a loan with no job, there are strategies you can use. This guide explains your options, the risks, and alternative resources available.

What Are Personal Loans With No Income Verification?

A personal loan with no income verification is designed for borrowers who don’t have traditional employment or steady paychecks. Instead of requiring proof of salary, lenders may look at your credit history, bank statements, or alternative income sources such as freelance work, benefits, or rental income.

These loans are attractive if you’re getting a loan without a job, but they usually come with higher interest rates and stricter repayment terms. Some lenders market them as “emergency loans” or “loans for bad credit,” appealing to those who say, “I need money today no job.” However, they should be approached carefully, since lenders assume more risk when no income verification is required.

How Lenders Determine If You Qualify for a Loan

Even without a job, lenders want reassurance that you’ll pay them back. Here are factors they use:

- Credit Score – A strong score may show you are financially responsible. If you’re researching how to get a loan with bad credit and no job, expect fewer options and higher interest.

- Alternative Income – Unemployment benefits, disability payments, alimony, or side hustles may count as income.

- Collateral – Some lenders may offer secured loans if you can pledge assets like a car or savings account.

- Debt-to-Income Ratio – Even without employment, lenders analyze your monthly expenses compared to any sources of money you do have.

Understanding these criteria is key when figuring out how to get a loan without a job or at least improve your approval chances.

Checking Online Lenders

Traditional banks are usually strict, but online lenders often provide flexible options. Platforms specializing in personal loans may allow you to get a loan with no job if you can demonstrate alternative ways to repay.

Advantages of online lenders:

- Quick applications and instant pre-approval.

- Options for those with limited or poor credit history.

- Access to specialized products for borrowers who are getting a loan without a job.

Still, research is crucial. Compare interest rates, fees, and repayment terms before signing anything. Some online lenders may target vulnerable borrowers with high-cost loans, especially those who search “need money today no job.” Always read the fine print.

Risks When Taking Out a Personal Loan While Unemployed

Borrowing without a job can provide temporary relief but also long-term financial stress. Consider the following risks:

- High Interest Rates – Loans for unemployed borrowers often cost significantly more.

- Short Repayment Terms – Some lenders expect repayment within weeks or months.

- Debt Trap – If you can’t repay, you may end up borrowing more, creating a cycle of debt.

- Credit Damage – Defaulting on a loan worsens your score, making it harder to qualify in the future.

If you’re thinking “can you get a personal loan with no job?” the answer may be yes—but at what cost? Understanding these risks will help you make a smarter decision.

What to Do if You’re Not Approved

If your loan application is denied, don’t panic. Many unemployed borrowers face this. Here’s what you can do instead:

- Look Into Unemployment Benefits – These may give you enough breathing room until you find work.

- Apply for Government Assistance – Food, housing, or healthcare support may free up money for other expenses.

- Borrow From Friends or Family – Not always easy, but often cheaper and less risky than payday lenders.

- Consider Gig Work – Freelancing, delivery driving, or part-time online work may help you show income.

- Use Credit Counseling Services – Nonprofits can help restructure your debt.

When denied, shift your focus from how to get a loan with bad credit and no job to improving your financial profile. Sometimes, building stability before applying again is the smartest move.

Additional Finance Help For The Unemployed

If loans aren’t the best solution, there are other ways to access cash and support:

- Emergency Assistance Programs – Many cities and states provide short-term financial aid.

- Charities and Nonprofits – Organizations like United Way help with rent, utilities, and essentials.

- Credit Unions – These often have small-dollar loan programs with more flexible terms.

- Community Resources – Food banks, housing services, and utility relief programs can ease financial pressure.

Instead of rushing into high-interest debt, explore these safer options before saying, “I need money desperately no job.”

Other Ways to Qualify for a Personal Loan While Unemployed

If you’re determined to pursue a loan, there are creative ways to increase approval odds:

- Add a Co-Signer – A friend or family member with good credit can improve your chances.

- Show Proof of Assets – Savings, investments, or even property can act as repayment assurance.

- Use Collateral – Secured loans backed by your car, jewelry, or savings may be easier to obtain.

- Provide Alternative Income Sources – Child support, pension payments, or freelance income can count.

So if you’re asking, can you get a personal loan without a job? the answer is yes, if you can show lenders another way to repay.

Factors Lenders Consider If You’re Unemployed

| Factor | Why It Matters | How It Helps Approval |

|---|---|---|

| Credit Score | Shows history of repayment | Higher score = better terms |

| Alternative Income | Benefits, side jobs, alimony | Proves ability to repay |

| Collateral | Assets like car, savings | Lowers lender risk |

| Co-Signer | Someone with good credit backs you | Increases approval odds |

| Debt-to-Income Ratio | Measures expenses vs. income | Lower ratio = stronger case |

✅ Safer Alternatives Instead of Taking a Loan

- Apply for unemployment benefits

- Seek help from community assistance programs

- Contact nonprofit credit counselors

- Use food banks and housing support to free up funds

- Borrow small amounts from trusted friends or family

FAQ

1. Which Personal Loans Don’t Require Proof of Income?

Some online lenders, payday loan companies, and credit unions offer loans without strict income verification. However, these often come with higher costs and should only be used as a last resort.

2. Can You Get a Personal Loan With No Income?

Yes, but you’ll usually need collateral, a co-signer, or alternative sources of money such as benefits. Most lenders want reassurance that repayment is possible, even if you’re unemployed.

3. Are There Unemployment Benefits If You Don’t Have a Job?

Yes. In most cases, unemployment benefits are available if you lost your job through no fault of your own. They provide temporary income while you search for new employment.

Bottom Line

If you’re unemployed and asking, how to get a loan without a job, know that options exist—but they come with risks. While you may be able to get a loan with no job, approval often requires collateral, a co-signer, or proof of alternative income. Be wary of predatory lenders who target desperate borrowers with phrases like, “need money today no job.”

Before taking on debt, explore safer alternatives like unemployment benefits, community programs, or side income opportunities. If you do pursue a loan, compare lenders carefully, understand repayment terms, and avoid borrowing more than you can reasonably pay back.

In short: can you get a personal loan with no job? Yes—but it should never be your only plan. By weighing risks, considering alternatives, and focusing on long-term stability, you’ll avoid financial traps and create a foundation for future security.

A personal finance writer with over a decade of experience, Stacy Marriott helps readers navigate credit, banking, and smart money management. She specializes in delivering practical, easy-to-understand advice for improving credit, managing debt, and making informed financial decisions.